I read this morning the results of a survey conducted by the National Association of Realtors that 87% of non-homeowners believe they need 10% down or more to purchase a home. This is entirely inaccurate and I am very surprised that so many people do not know better. So for your "good deed of the day", spread the word that the minimum down payment for purchasing a home is normally around 3%. Sure, there are Jumbo loans and other circumstances that require a larger than 3% down payment. However, with the majority of loans 3% is sufficient, and in some cases a 1% down payment is available (and Veterans loans allow 0% down payment)!

The monthly payment is higher when you put less down, but the barrier to entry for most home buyers is the down payment - not monthly payment. Once you are in the game, you are normally in it to stay as your home equity will move with the market (up or down).

As always, I am excited to discuss these topics and can be found at www.FirstAmericanMortgage.net

Thank you very much!

Wednesday, March 1, 2017

Friday, February 3, 2017

FHA Mortgagge Insurance Premium - Up, Down, Up

Many of you have read about the FHA mortgage insurance premium reduction being suspended by Ben Carson, the newly appointed head of The Department of Housing and Urban Development (HUD). The plan was on 1/27/17, the FHA mortgage insurance premiums were going to be reduced for the majority of the products offered by FHA. The principle reason is the insurance coffers at FHA have been replenished since paying out millions in claims as a result of the mortgage crisis. However, there was also the end result of the premium reduction that netted a lower payment for borrowers - causing a bit of concern when the reduction was suspended. All this being said, we are back at square one with FHA products.

So let me tell you where square one is:

1. A mortgage product with few pricing differences for credit scores from 500 - 850. Credit score and history is not a large factor with FHA products.

2. A mortgage product that, no matter how large your down payment, has mortgage insurance that NEVER goes away no matter your equity position over the life of the loan.

3. A mortgage product with a 1.75% upfront mortgage insurance premium ($300,000 x 1.75% = $5,250) in addition to the monthly mortgage insurance.

4. A mortgage product that will allow you to purchase a duplex, triplex, fourplex with 3.5% down payment.

5. A mortgage product that will allow you to buy a property and completely remodel/renovate down to the foundation and build additional structures (garage, ADU, etc.) with only 3.5% down payment.

The bottom line is that although there are a very few borrowers who may have been hurt by this suspense of the monthly mortgage insurance premium, FHA products are not long term products and should not be used as such. They are meant to be used the way a pole vaulter uses the pole. To get up to the place you need to be. Then once you are up to the bar (stick with me on the pole vaulting references here), you refinance out of that FHA product to a conventional product when your credit is better, your renovated home has given you equity, or your multi-family property has paid down the loan balance - and you clear the bar and perform your "fly-away" and let go of the pole (or FHA loan).

HUD is doing what it has to in order to keep this "pole" or "facilitation" product viable and if that means we stay at the higher monthly mortgage insurance premiums so creative buyers have a product, so be it. It is a good product for those who know how to use it. Also, HUD is being cautious and conservative to ensure the replenishment of the coffers is actual and sufficient - not a bad idea at all!

I am always available to discuss FHA/HUD or any real estate financing questions you might have at www.FirstAmericanMortgage.net

Thank you very much!

So let me tell you where square one is:

1. A mortgage product with few pricing differences for credit scores from 500 - 850. Credit score and history is not a large factor with FHA products.

2. A mortgage product that, no matter how large your down payment, has mortgage insurance that NEVER goes away no matter your equity position over the life of the loan.

3. A mortgage product with a 1.75% upfront mortgage insurance premium ($300,000 x 1.75% = $5,250) in addition to the monthly mortgage insurance.

4. A mortgage product that will allow you to purchase a duplex, triplex, fourplex with 3.5% down payment.

5. A mortgage product that will allow you to buy a property and completely remodel/renovate down to the foundation and build additional structures (garage, ADU, etc.) with only 3.5% down payment.

The bottom line is that although there are a very few borrowers who may have been hurt by this suspense of the monthly mortgage insurance premium, FHA products are not long term products and should not be used as such. They are meant to be used the way a pole vaulter uses the pole. To get up to the place you need to be. Then once you are up to the bar (stick with me on the pole vaulting references here), you refinance out of that FHA product to a conventional product when your credit is better, your renovated home has given you equity, or your multi-family property has paid down the loan balance - and you clear the bar and perform your "fly-away" and let go of the pole (or FHA loan).

HUD is doing what it has to in order to keep this "pole" or "facilitation" product viable and if that means we stay at the higher monthly mortgage insurance premiums so creative buyers have a product, so be it. It is a good product for those who know how to use it. Also, HUD is being cautious and conservative to ensure the replenishment of the coffers is actual and sufficient - not a bad idea at all!

I am always available to discuss FHA/HUD or any real estate financing questions you might have at www.FirstAmericanMortgage.net

Thank you very much!

Tuesday, December 27, 2016

Merry Christmas and Happy New Year!

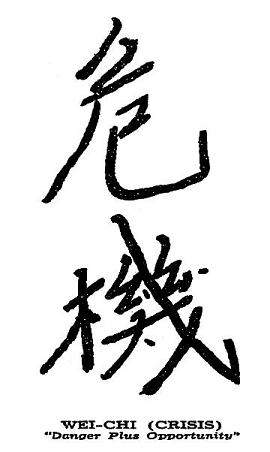

I wanted to take a moment to wish everyone a very happy holiday season and new year. 2016 has been tumultuous and prosperous. The consumer sentiment of the economy is at a multi-year high and people are spending. The election results have many people cautious and reeling, but at the very least - they are feeling good about where the economy is heading. This reminds me of Wei-Chi where in the Chinese language the word "crisis" is composed of two characters meaning "danger" and the other "opportunity". May you find your opportunity amidst the danger in 2017. We are always looking for brainstorming and your thoughts at www.FirstAmericanMortgage.net

Thank you!

Thank you!

Friday, November 11, 2016

Happy Veterans Day!

Thank you to all of the Veterans for your service. It is truly appreciated.

***Especially to my father who is an honorably discharged U.S. Marine flamethrower in Vietnam***

www.FirstAmericanMortgage.net

***Especially to my father who is an honorably discharged U.S. Marine flamethrower in Vietnam***

www.FirstAmericanMortgage.net

Wednesday, September 28, 2016

Our Video - Four Year Old Message, Better Results

Have you see our video? If not, take a look below. Not much has changed since we recorded with http://3dbproductions.com/Full_Site/index_002.html in 2012, except for increased savings and better products for our customers. Large banks have increased their fees and become less creative while First American Mortgage, PLLC has remained streamlined and more inventive. We are always happy to help at www.FirstAmericanMortgage.net

Thank you very much!

Thank you very much!

Friday, August 26, 2016

Get Clean By Eating Clean - The Cleanse!

Last month, I went through the 21 Day Clean Eating and Workout Challenge with Kim Wilson Pollock. Here is the link to Kim's website:

http://www.kimwilsonpollock.com/21-day-clean-eating-workout-challenge/.

It was fantastic! I can't believe the changes that my body went through and how addicted I am to sugar and wheat. About 15 years ago, I gave up smoking cigarettes and that was a radical change due to the addiction I had developed. So over the last 15 years I've been walking around feeling so awesome that I am addiction free - not quite. Giving up sugar and wheat on Kim's cleanse gave me very similar symptoms as when I quit cigarettes. I consider myself to be very fit. This cleanse proved to me I am not as healthy as I thought - it was incredibly enlightening!

The best thing about the 21 Day Clean Eating and Workout Challenge was the camaraderie that was built between all the people doing the cleanse all over the country (Facebook and texting with accountability partners) and Kim's daily e-mails with tips and descriptions of the things we were going through. It is definitely a "challenge" and these two things made success more attainable.

I highly recommend Kim's program to anyone regardless of your fitness level. It is truly an eye opening experience into your body.

As always, I am available to discuss the cleanse or any finance matters at: www.FirstAmericanMortgage.net

Thank you!

http://www.kimwilsonpollock.com/21-day-clean-eating-workout-challenge/.

It was fantastic! I can't believe the changes that my body went through and how addicted I am to sugar and wheat. About 15 years ago, I gave up smoking cigarettes and that was a radical change due to the addiction I had developed. So over the last 15 years I've been walking around feeling so awesome that I am addiction free - not quite. Giving up sugar and wheat on Kim's cleanse gave me very similar symptoms as when I quit cigarettes. I consider myself to be very fit. This cleanse proved to me I am not as healthy as I thought - it was incredibly enlightening!

The best thing about the 21 Day Clean Eating and Workout Challenge was the camaraderie that was built between all the people doing the cleanse all over the country (Facebook and texting with accountability partners) and Kim's daily e-mails with tips and descriptions of the things we were going through. It is definitely a "challenge" and these two things made success more attainable.

I highly recommend Kim's program to anyone regardless of your fitness level. It is truly an eye opening experience into your body.

As always, I am available to discuss the cleanse or any finance matters at: www.FirstAmericanMortgage.net

Thank you!

Tuesday, August 9, 2016

Brokers vs. Banks

Take a look at this video that pinpoints the reasons why at www.FirstAmericanMortgage.net you simply get the best value.

https://www.findamortgagebroker.com/?utm_source=et&utm_medium=email&utm_campaign=promoemail

Sure, there are plenty of people that would rather pay more and use a bank or credit union to originate their mortgage. I, however, do not like to pay more and always try to look for the best value. Brokers are simply the better choice.

Thank you!

https://www.findamortgagebroker.com/?utm_source=et&utm_medium=email&utm_campaign=promoemail

Sure, there are plenty of people that would rather pay more and use a bank or credit union to originate their mortgage. I, however, do not like to pay more and always try to look for the best value. Brokers are simply the better choice.

Thank you!

Tuesday, July 26, 2016

Available Now - 1% Down Payment on Purchases!!!

We have the pleasure of offering a 1% down payment program for home purchases! There are some tremendous opportunities to be gained before rates go up and this program highlights that. This is a great option for anyone looking to buy a new home.

This program is new, so please contact us at www.FirstAmericanMortgage.net to learn more.

Check out this video on the program!

This program is new, so please contact us at www.FirstAmericanMortgage.net to learn more.

Check out this video on the program!

Wednesday, July 13, 2016

S&Q's Maui

We recently went on vacation to Maui and had the most wonderful breakfasts at this little coffee, shave ice and food spot.

If you want to chat about Maui or Mortgage Finance - you can always find me at www.FirstAmericanMortgage.net

If you want to chat about Maui or Mortgage Finance - you can always find me at www.FirstAmericanMortgage.net

Thursday, June 2, 2016

Are we experiencing inflation?

What do you think? Are we experiencing inflation? We know that all of the economic indicators, including equilibrium real interest rate (sometimes called the

Wicksellian interest rate, after the late-nineteenth- and early

twentieth-century Swedish economist Knut Wicksell) are saying that the US economy is not experiencing inflation, but do you think things generally cost more today than they did five years ago?

After reading Ben Bernanke's blog http://www.brookings.edu/blogs/ben-bernanke/posts/2015/03/30-why-interest-rates-so-low it is apparent that the CPI indicators are pointing to "no inflation". At the same time, does the Fed and Bernanke live on Fantasy Island? Besides oil (artificially low by increased domestic production to specifically pressure the Russian economy - note the price of oil at the Crimea crisis), commodities whose price base is foreign currency, and other durable goods made overseas (primarily China - manipulated Yuan), what products or service have become less expensive? Seriously - what has?

Now, we understand that economists and the Fed are confined by economic models and indices derived from years of statistical and actuarial analysis, so sometimes they cannot call "a spade a spade". But with that in mind, do they own rental property? Do they pay property taxes or insurance premiums? Do they send their children (grandchildren) to school? Do they purchase food? Do they hire labor? Do they (or their contractors) purchase building materials? Do they travel? Do they attend entertainment venues?

As you can see, this list can go on and on. The encompassing number of goods and services that have increased substantially in price is impossible to ignore (unless you live in the Ivory Tower with Ben, Jan and the gang). The CPI numbers are manipulated to the advantage of social programs and the federal government. If they CPI reflected the actual costs of goods and services of our economy, the Social Security system would go bankrupt tomorrow due to the cost of living adjustment they would need to provide to payees...among every other cost of living adjustment paid in this economy.

Yes, those on a fixed income are being squeezed more than ever with the rising cost of everyday goods and services. Big box retailers have voluntarily increased wages for employees, but it is not enough for the Fed to realize inflation. We will look back on the period from 2010 to 2016 as a period of domestic inflation shrouded by statistics and artificially priced commodities and goods.

As always, we are available to brainstorm on financial topics at www.FirstAmericanMortgage.net

Thank you very much!

After reading Ben Bernanke's blog http://www.brookings.edu/blogs/ben-bernanke/posts/2015/03/30-why-interest-rates-so-low it is apparent that the CPI indicators are pointing to "no inflation". At the same time, does the Fed and Bernanke live on Fantasy Island? Besides oil (artificially low by increased domestic production to specifically pressure the Russian economy - note the price of oil at the Crimea crisis), commodities whose price base is foreign currency, and other durable goods made overseas (primarily China - manipulated Yuan), what products or service have become less expensive? Seriously - what has?

Now, we understand that economists and the Fed are confined by economic models and indices derived from years of statistical and actuarial analysis, so sometimes they cannot call "a spade a spade". But with that in mind, do they own rental property? Do they pay property taxes or insurance premiums? Do they send their children (grandchildren) to school? Do they purchase food? Do they hire labor? Do they (or their contractors) purchase building materials? Do they travel? Do they attend entertainment venues?

As you can see, this list can go on and on. The encompassing number of goods and services that have increased substantially in price is impossible to ignore (unless you live in the Ivory Tower with Ben, Jan and the gang). The CPI numbers are manipulated to the advantage of social programs and the federal government. If they CPI reflected the actual costs of goods and services of our economy, the Social Security system would go bankrupt tomorrow due to the cost of living adjustment they would need to provide to payees...among every other cost of living adjustment paid in this economy.

Yes, those on a fixed income are being squeezed more than ever with the rising cost of everyday goods and services. Big box retailers have voluntarily increased wages for employees, but it is not enough for the Fed to realize inflation. We will look back on the period from 2010 to 2016 as a period of domestic inflation shrouded by statistics and artificially priced commodities and goods.

As always, we are available to brainstorm on financial topics at www.FirstAmericanMortgage.net

Thank you very much!

Monday, May 16, 2016

The Best Land Purchase In History

The best land purchase in history was the Louisiana Purchase constructed and negotiated by Thomas Jefferson. He negotiated the purchase of almost the entire western half of the United States from France for $15m. Besides being one of the architects to the Constitution, this was Thomas Jefferson's greatest contribution to our country.

Below is a photo that I took while I was visiting http://www.boulderriverside.com/ and could not help but notice what a profound statement it is. The piece says:

"If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered...I believe that banking institutions are more dangerous to our liberties than standing armies... The issuing power should be taken from the banks and restored to the people; to whom it properly belongs". TJ is one of my favorite historical figures and I would love to hear your thoughts at www.FirstAmericanMortgage.net

Thank you!

Below is a photo that I took while I was visiting http://www.boulderriverside.com/ and could not help but notice what a profound statement it is. The piece says:

"If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered...I believe that banking institutions are more dangerous to our liberties than standing armies... The issuing power should be taken from the banks and restored to the people; to whom it properly belongs". TJ is one of my favorite historical figures and I would love to hear your thoughts at www.FirstAmericanMortgage.net

Thank you!

Thursday, March 24, 2016

5 Ways to Boost Creativity

We all want to be more creative. Here are some tips on how to do so while maintaining relevant and consistent business acumen.

1. Be Diverse: Diverse teams can be much more creative than individuals because several brains naturally generate more ideas than a single brain. In contrast, too much or the wrong kind of diversity can hurt. To be most creative, teams should have people of differing skills, talents and backgrounds, but with similar values and motivations. Having a common goal is the key!

2. Reduce Time Pressures: Necessity is the mother of innovation, but not always under time constraints. Studies have shown that deadlines can inhibit creativity. Sure, we have all come up with magic in the 11th hour, but giving yourself more time will result in more creativity.

3. Take a Break: Relentlessly grinding away at a problem is less likely to produce a creative breakthrough than consistent effort combined with occasional breaks to rest, relax, and recharge. Engaging in exercise during breaks helps even more. Research shows people come up with more and better ideas while walking than while standing still. And don't discount meditation. The regular practice of mindfulness has been consistently connected with greater creativity.

4. Change the Scene: We can all agree that getting out of our "space" allows us to be able to step outside the problem and look from a different angle. This is the key to changing the scene. A day long idea-generating meeting can be productive, but is much more so if held off-site. Moving away from familiar surroundings creates unfamiliar thought patterns.

5. Embrace Failure: Anyone who is creative is bound to fail - it is part of the game. The key is to not punish the failure, but to reward it. Punishing failure will deter creative thinking.

Let us know what you use to stay creative. We are always available at www.FirstAmericanMortgage.net

Thank you very much!

1. Be Diverse: Diverse teams can be much more creative than individuals because several brains naturally generate more ideas than a single brain. In contrast, too much or the wrong kind of diversity can hurt. To be most creative, teams should have people of differing skills, talents and backgrounds, but with similar values and motivations. Having a common goal is the key!

2. Reduce Time Pressures: Necessity is the mother of innovation, but not always under time constraints. Studies have shown that deadlines can inhibit creativity. Sure, we have all come up with magic in the 11th hour, but giving yourself more time will result in more creativity.

3. Take a Break: Relentlessly grinding away at a problem is less likely to produce a creative breakthrough than consistent effort combined with occasional breaks to rest, relax, and recharge. Engaging in exercise during breaks helps even more. Research shows people come up with more and better ideas while walking than while standing still. And don't discount meditation. The regular practice of mindfulness has been consistently connected with greater creativity.

4. Change the Scene: We can all agree that getting out of our "space" allows us to be able to step outside the problem and look from a different angle. This is the key to changing the scene. A day long idea-generating meeting can be productive, but is much more so if held off-site. Moving away from familiar surroundings creates unfamiliar thought patterns.

5. Embrace Failure: Anyone who is creative is bound to fail - it is part of the game. The key is to not punish the failure, but to reward it. Punishing failure will deter creative thinking.

Let us know what you use to stay creative. We are always available at www.FirstAmericanMortgage.net

Thank you very much!

Tuesday, March 1, 2016

Super Tuesday!

In going over the minutes from the recent Downtown Management Commission today, I find it interesting that the Human Rights Commission has petitioned the Boulder City Council to allow camping in Boulder city parks. Could you imagine? Tons of homeless people camping in Bella's Park or Scott Carpenter Park - mayhem. It makes you wonder, how does a group called the Human Rights Commission expect to retain credibility with positions like this - allowing camping in the city parks! For those of you that don't know Boulder, it may sound rational to allow camping in city parks. However, those of you that do know Boulder understand that there are very few parks and an abundance of homeless...enough so that the parks would be overrun. There is mention in the minutes of the many fine programs and facilities that the City of Boulder does keep up to facilitate the care of homeless. The infrastructure is sound and quite capable to avoid having to turn our parks into the parking lot at Alpine Valley for a 1980's Dead show - not that there isn't a time and place for that (July 2016 Folsom Field http://www.deadandcompany.com/). It's just not appropriate for families and citizens that want to relax and enjoy a city park.

For more information on this, check out: https://bouldercolorado.gov/boards-commissions/downtown-management-commission

What does this have to do with Super Tuesday - it is Tuesday and it has been Super so far.

We would love to chat about your views on City of Boulder or general socioeconomic issues and can always be reached at: www.FirstAmericanMortgage.net

Thank you very much!

For more information on this, check out: https://bouldercolorado.gov/boards-commissions/downtown-management-commission

What does this have to do with Super Tuesday - it is Tuesday and it has been Super so far.

We would love to chat about your views on City of Boulder or general socioeconomic issues and can always be reached at: www.FirstAmericanMortgage.net

Thank you very much!

Thursday, February 18, 2016

Rate Drop!!!

Some investors had four price improvements today landing the 30 year fixed at 3.625%. So much for the interest rate hike from the Fed weeks ago! As always, we are available to talk "real estate financing" at www.FirstAmericanMortgage.net

Thank you very much!

Thank you very much!

Tuesday, February 9, 2016

Townhome and Condominium Breakdown

| Questions: www.FirstAmericanMortgage.net | ||||

|

Purchasing a townhome or, even more so, a condo works just a

little bit differently from purchasing a residence, which typically

isn't subject to some type of homeowner association (HOA). When you purchase a townhome, you will own both the structure and the land underneath it. With a condo, you will own the structure, but the land it sits on will be part of what is called the common parcel. With townhomes, association fees tend to be lower, though it's likely that fewer services will be provided. Condo associations tend to be more hands-on, with responsibility for painting or refacing the outside and common areas of the building, landscaping, and other maintenance tasks. Your monthly dues will reflect this. Before deciding to purchase your dream townhome or condo, sit down with your real estate attorney and scrutinize the association bylaws to make sure you understand them. You also need to get a clear picture of the finances of the association. Unlike with a single or detached family home, the HOA is a very important consideration when purchasing a townhome or condo association, and you need to make sure it's financially sound. The last thing you want to do is to purchase a property whose association is mismanaged or, worse yet, on the verge of financial collapse. Your lender will go through all this information very carefully during the lending process, looking for situations that either exist now or could become issues in the future. But you need to understand it yourself, too. There are many great townhome and condo developments out there. Lower-maintenance living is ideal for some, particularly downsizing retirees and those who don't have time for, or don't enjoy, home maintenance. However, make sure you know what you are getting into before-not after-you purchase a home that comes with an HOA. Your real estate agent, mortgage professional, and real estate lawyer can help you get the information you need. | ||||

Subscribe to:

Posts (Atom)